Break Even Day for a Business

The break-even point in a company’s sales is extremely important to Management, since it marks the very lowest level to which activity can drop without putting the continued life of the company in jeopardy. It indicates the level of sales you need just to cover all costs.

To understand break-even, one must first be clear about which are the fixed costs of the business and which are the variable costs. Fixed costs, such as rent and rates, by definition tend to remain unchanged over a period and will have to be met whatever level of production or sales is achieved; though of course in the long run all costs will fluctuate at some point (e.g. new premises taken on to cope with increased output would incur increased rent and rates). Never forget that with sole traders or partnerships the proprietors drawings are a real fixed cost. Variable costs are those which tend to increase or decrease in proportion to an increase or decrease in production. Examples of variable costs include raw materials and piecework.

Break-even can be shown graphically by way of a profit/volume chart or ‘standard ‘ break-even graph. However, a far quicker method is to calculate the level of sales required to achieve break-even mathematically.

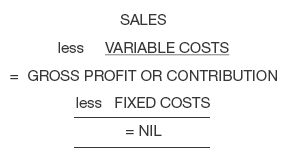

When break-even occurs, the trading account of a business would show:

i.e. both variable and fixed costs have been exactly covered. or to put it another way, break-even occurs when gross profit = fixed costs.

Gross profit (or contribution) can also be calculated by multiplying sales by gross profit margin (or contribution factor) i.e. sales x gross margin % = gross profit. Therefore, when break-even occurs

- Sales x gross margin% = Fixed costs

- and we find

- Sales to break-even = Fixed costs divided by gross margin%

For example: A company has fixed costs totalling £45,731 and maintains a gross margin of 35%.

The level of sales to break-even is therefore:

- £45731 divided by 35% or

- £45731 divided by 35 x 100 = £130,660

This can easily be proved:

- Sales = 130,660

- Gross Profit (35%) 45731

- Fixed Costs 45731

- NIL

Thus the business knows that it needs to sell at least £130,660 worth of goods before it begins to earn profits. Anything less than that and it will make a loss equivalent to 35% of the shortfall; anything more than that will result in a net profit of 35% of the excess (i.e. the Gross Margin multiplied by the shortfall or excess).

By dividing the break-even sales figure down into days, weeks or months, depending upon the type of business and degree of control required, the management of the business can keep a constant eye upon whether it is making profits or losses on a regular and up-to-the-minute basis.

It is also interesting, after first having calculated the break-even sales figure, to compare that with the annual sales to find out at what point during the year break-even occurred.

- i.e. Break-even sales divided by total sales x 100 would give you this measurement in % terms.

- or Break-even sales divided by total sales x 52 (or 12 or 365) would give you this measurement in weeks (or months or days) .

It does not really matter which calculation is used but what is important is to look at the calculation over a period. For instance if the calculation reveals a break-even timing of

42 weeks 44 weeks 47 weeks

over a period of say three years, common sense tells us that if this trend continues, then at some stage in the near future, break-even will occur at 53 or more weeks – i.e. a loss will be made.

It is therefore most important for the businessman to ensure that the timing of break-even shortens over a period rather than lengthens (or at the very least that it stays the same).

If we look at the two simple calculations above

- of 1) Sales to break-even = Fixed costs dived by gross margin %

- & 2) Timing of break-even = Sales to break-even x 52 etc divided by sales

it quickly becomes obvious that timing of break-even can only be shortened if we

- 1) Increase gross margin

- or 2) Reduce fixed costs

- or 3) Increase total sales

(1) Can be achieved by reducing variable costs or by increasing prices or by changing product mix.

(2) Is straightforward enough – Fixed costs must always be kept under strict control.

- Remember three cardinal rules apply here:–

- a. Concentrate on significant costs

- b. Concentrate on easily reducible costs

- c. Work to a plan

(3) This is the method quite often adopted by the businessman but he must be very careful that he does not

- a) Reduce prices to increase sales to such a degree that the increased sales income is more than negated by the reduced gross margin

- OR

- b) Allow ‘ fixed’ costs to follow increased output – as this could again negate any increase in gross profit

Though it may seem like a ‘slice of the obvious’, examining break-even has therefore brought us back to the fundamentals of the financial side of any business – the areas which a businessman must always control and must always monitor:

- Pricing policy (and by implication – costings)

- Costs control

- Sales volume

- Product mix

USES OF BREAK-EVEN

So, we know how to calculate break-even and what its constituent parts are, but how does the businessman use it?

Given that in a well run business, monthly (or weekly) breakeven point and gross margin % should stabilize at broadly the same level each month (or week), management of a business need only know the monthly sales figure to quickly and roughly determine monthly profitability. Furthermore, from the order intake for the month it is possible to gain some idea of future profitability.

As indicated above several methods are then available to help a business to survive in virtually any type of market, good or bad , by deliberately “moving” its break-even point or more particularly the break-even timing. Perhaps it is another ‘slice of the obvious’ but it needs to be remembered that although events in the outside world are largely outside the businessman’s control, his break-even point is largely within his control. As stated above he can force it down by increasing his gross margin %, decreasing his fixed costs or by selling more (assuming gross margin % and fixed costs remain the same).

Reacting to a market drop

If there is a drop in market demand , a business must react by reducing its break-even point however painful and traumatic. What it must not do is to hope that the market lull is only temporary and soldier on hoping for better days. There are many bad debts about to prove this point!

Often, businesses seem only to know how to go forward. They react to falling turnover by cutting prices, by trying to sell more and increasing their costs. As often as not, this merely hastens the end. Those who succeed use equally forceful techniques for moving backwards knowing how to close a loss-making gap by selling less rather than selling more.

Reacting to increased sales

Having got its break-even point right in relation to the market, a business should not allow it to rise with rising sales, or at least not allow it to move more than it has to. The business should be taking full advantage of the rising sales by way of extra profit and cash flow not throwing it away. Therefore, accurate monitoring of break-even is essential – what was it last week? – what is it this week? – what will it be next week!

So those are the uses to the businessman, but what about the lender?

Quite obviously, they have a duty to educate its customers by sharing this information with them. In addition, they can monitor the progress of a business by using the above. They can also apply these techniques to new start-up situations or requests for increased borrowing to support an expansion of the business.

A full understanding of the break-even of a business will enable them to talk to its customers more professionally.